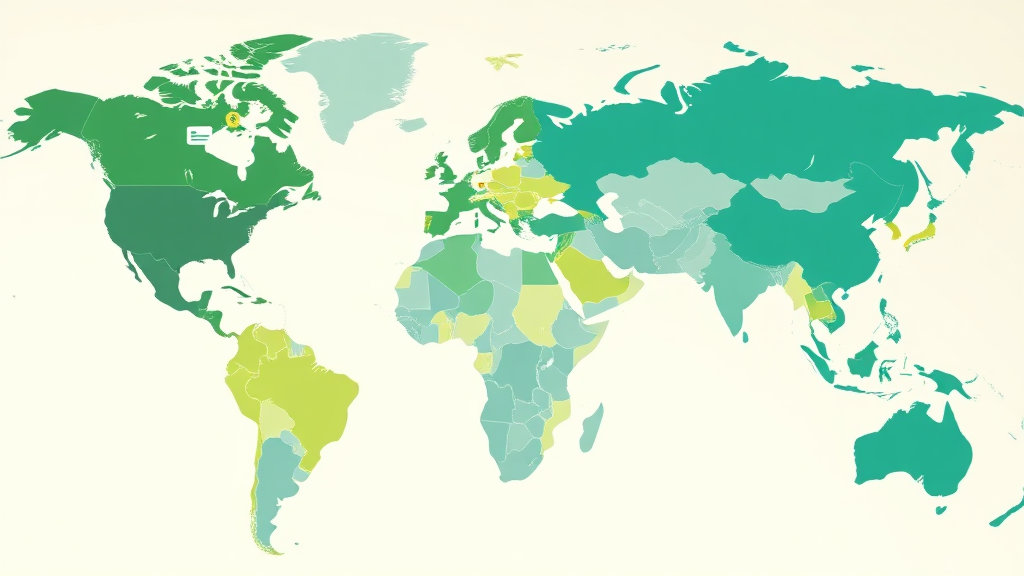

Why AdSense Pays More in Some Countries Than Others

Country-Based RPM Differences Aren’t Just About GDP

At first I thought higher RPMs just tracked with how rich a country is. Spoiler: they don’t. Brazil’s GDP is nearly 10x that of Poland, but Polish traffic converts higher for AdSense. That stumped me hard until I started watching the types of ads showing on each geo and who’s bidding.

Advertisers aren’t bidding based on national GDPs — they’re bidding based on user value, behavioral trends, and whether that geo even supports conversion for their offer. For example, you’ll see American SaaS platforms pay top dollar on Canadian impressions just because cross-border conversion friction is zero. Meanwhile, even a high-income user in Qatar might be served low-end display ads due to low advertiser demand in Arabic or lack of localized landing pages.

If you run multilingual blogs, go peek at Ad Review Center filtered by country — the difference in ad presentation is genuinely wild. I’ve seen premium edtech video spots running in Germany while the Kenyan audience gets ancient banner filler that probably never converted.

Payment Thresholds Create Behavioral Lag in Lower-Income Regions

This one snuck up on me. If you’re getting a decent amount of traffic from Nigeria or Bangladesh, and you’re puzzled why the earnings hover near dead zero despite impressions, here’s something to consider: AdSense won’t pay out until you reach the country’s currency equivalent of the minimum payout threshold. It’s $100 in USD-equivalent, but reaching that might take months or even years if the RPM remains somewhere under the espresso line.

I had one old blog with a spiky user base in The Philippines. Weirdly, it would show hundreds of daily views, but I didn’t see a dime for months. But the revenue was real — just stuck floating in the void. AdSense won’t dribble partial payments. Until you beat the threshold, it acts like a ghost balance. And every delayed payout step contributes to sloppy publisher behavior: people stop optimizing, stop logging in — and at some point, the annoyance just piles up.

Honestly, it might even reinforce the RPM gap long-term — because low-earning regions become low-engagement on the publisher side too.

Ad Auction Density Varies by Region (aka Fewer Bidders, Lower RPM)

There’s a dynamic I didn’t appreciate until I started actually watching the AdSense auction diagnostics graphs inside Ad Manager. For some countries, there simply aren’t as many bidders in the Google Ads ecosystem. And even if bids exist, they’re not aggressive.

Here’s the fluke that clued me in: I was helping a buddy monetize an Albanian movie reviews site. Funny niche, but the traffic was healthy. The earnings, however, were hilariously bad. We ran one test: force-sandboxed expected CPM versus live test CPM — the drop was 90%. Almost no bids were even eligible against that inventory. It was like a silent auction room where nobody showed up unless we offered cookies and first-party logins (which we didn’t).

The fix? Not a real one. But routing traffic through a landing filter or offering translation to English dramatically shifted what ads Google served (bingos like Grammarly, Notion, and even NordVPN started showing up). Which confirmed: more bidders = better auction = RPM doesn’t suck. Location just controls bid reality.

Language Can Be the Hidden Multiplier (or Black Hole)

I once published duplicate content on two domains: one English, one full Arabic. Same article, same layout, same domain authority (more or less). The English version earned basically 7–8x more. And it wasn’t even US traffic; these were identical countries with bilingual users opting into languages they preferred. Turns out, language determines ad ecosystem depth — and English is stacked.

Got this in a JSON log from my AdSense API:

{“adRequestLang”:”ar”,”auctionResult”:”fallback”,”bids”:[]}

That “bids”:[] sent me spiraling. Arabic ads literally didn’t get valid bidders. So unless there’s an specific advertiser targeting Arabic audiences *and* the auction favors your inventory, a lot of that page real estate rolls through fallback filler. Yes, language targeting matters. But language saturation — how many advertisers can deliver localized creatives dynamically — is just as important, and it’s rarely documented.

Advertiser Vertical Penetration Creates Market Inertia

Everyone talks about programmatic demand, but not all verticals bother globalizing. B2B SaaS and financial services? Great in the US, UK, Canada. But good luck finding programmatic spend for those niches in Indonesia or Peru. Even fashion and ecommerce ads — you’d expect those to scale globally — often don’t localize effectively. At least with affiliate networks, you can direct-geo target and switch tracker IDs. But with AdSense, the whole ecosystem has to work, or it just doesn’t.

Here’s where things get weirdly deterministic:

- Medical equipment ads pay hilariously well in Germany, near-zero in Singapore

- VPN ads are strong across Eastern Europe but vanish entirely in South Asia

- Pet product ads (like Purina) show up in Canada but rarely in Southeast Asia

- SaaS planner tools (like ClickUp) seem to saturate Australian traffic weirdly well

- YouTube Music banners serve frequently in India even when RPMs suck

Different verticals seed different countries — and over time, the median RPM for that country just becomes quietly governed by who showed up to bid and who hasn’t yet bothered localizing.

Cookie Consent Laws Absolutely Mangle EU RPM

One of the major revenue faceplants I’ve had was post-GDPR rollout. On sites with a meaningful chunk of Dutch and Belgian traffic, I started watching revenue dip even while impressions stayed static. My lazy cookie banners (just a pop-up with an “Okay” button) weren’t cutting it. More people started opting out, and Google began enforcing stricter CMP requirements.

Here’s the kicker: if you’re in the EU and don’t use an IAB-approved consent platform, Google will auto-disable personalized ad delivery. That tanks RPM. No personalization, no high-value targeting, no retargeting — and goodbye to any decent advertiser interest. Your RPM just crawls into the basement because the auction isn’t valuable anymore.

I finally swapped over to Cloudflare’s CMP setup (after failing to make Cookiebot work with my messy DOM JavaScript layering), and RPM popped back up the same week across all EU pages. I can absolutely confirm: consent widgets are a revenue throttle, not just a formality.

Mobile vs Desktop Geo Revenue Split Is Not Equally Weighted

This is one I’m still chewing on. When you check device performance by country, it turns out mobile RPMs in India and Bangladesh are abysmally low — like comically so — versus their desktop counterparts. BUT in the US or even Germany, mobile RPMs aren’t that far off from desktop. Why? Well… it’s likely a combo of mobile ad inventory quality, cluttered rendering, user signal resolution, and bounced sessions.

Mobile users in some regions might also have ad blockers more actively deployed — or apps like UC Browser completely rewrite content rendering to strip the ad payload pre-delivery. It doesn’t matter if the impression fired in your AdSense stats. If the creative never rendered, there’s no engagement — and advertisers absolutely throttle future bids when interaction rates nosedive.

Part of what makes this extra confounding is how these trends vary per ad unit and layout slot. Sticky bottom anchors? Almost universally terrible on mobile across Asia. Mid-content 336×280? Depends on font scaling and scroll velocity. If you’re serious about fixing this, evaluate per-slot, per-country, per-device using custom channels. Don’t trust averages — they’re honest lies.

AdBlock Rates Are Geo-Correlated but Not in Straight Lines

I assumed Europe had the highest ad blocker rates. Spoiler again: no. Central American and Eastern European users sometimes run higher % of blocking than German or French traffic. It’s not just about tech awareness — it’s about the prevalence of terrible sites that made ad blocking feel mandatory. User culture drives blocker adoption, and publishers inherit the revenue vacuum that follows.

I dug into logs for one Bulgarian-language blog I run and realized Chrome Extension ad block usage was upward of 40%, and even fine, contextual display ads weren’t showing. But strangely, when I served identical layouts on a Croatian news portal clone, the blocker rate was way lower. Possibly due to fewer malicious players in the niche. But from a raw RPM lens? Huge variance. Same site template, totally different earnings.

Worth noting: some adblockers still respect Acceptable Ads (Adblock Plus variety), while others—like uBlock Origin—nuke everything. Detecting block rate per country helps explain dramatic regional RPM differences that otherwise make zero sense. And the worst part? Google doesn’t report this in AdSense UI. You have to go JavaScript side-channel or use proxy diagnostic tags to spot it.

Safari Users in High-Income Countries Still Earn Less

This one tripped me up during a Toronto client audit. We noticed that RPMs for Safari users in Canada were regularly sitting under Chrome equivalents by something like 30% on average. But only on iOS. Desktop Safari was more or less aligned. Apparently, the limited third-party cookie access in mobile Safari screws with targeting depth enough that advertiser returns degrade — and so they bid lower.

AdSense ends up treating that segment as less valuable just because advertisers don’t get their usual ROI. Doesn’t mean your content’s bad. Means your audience brought a digital chastity belt and Google can’t sell them fancy shoes.

That single behavioral bug — Apple’s ITP stripping cookies too aggressively — might be shaving hundreds a month off otherwise positive-performing Canadian or UK traffic. You mitigate it a little by using first-party data with Consent Mode V2 passed through GTM tags, but most of us aren’t that fancy. Split browser segment reporting in Analytics and check if Safari segments always dip lower in high-RPM countries. If yes, welcome to the club.