What Breaks (and Sorta Works) in Remote Payroll Systems

Misaligned Time Zones Wreak Havoc on Cutoff Dates

One of the first things that bit me in the neck when we hired devs across three continents: our payroll system had a static cutoff time, set in Pacific time. Which was fine for California, barely tolerable for Germany, and completely broke things for Bangalore. A junior dev there ended up missing a month of salary because his time-tracking app rounded after UTC midnight, and the payroll pulled those hours a day early.

The fix wasn’t fancy. We just updated the cron job to give a 24-hour grace period, but holy hell — we had to redo timestamps post-facto in the system because some hours had been misattributed in the payroll CSV. Turns out, the exported data was using employee browser time. Not server time. Let that sink in.

“Timestamp mismatch in export logs” was the real culprit. Not a missed entry. Not a bad calculation.

In some systems (Remote, Deel, etc.), the location info doesn’t update dynamically if a user changes their system clock. You can actually spoof your work hours by adjusting your OS timezone — which is dumb, but also a kind of hilarious loophole if you aren’t HR.

Double Deductions with Regional Tax Engines

If your payroll system pipes into local filing tools, keep a paranoid eye on tax deductions. We had a mess with an EU contractor who paid tax once through our platform and again when the local accountant tried to file. The problem? Our system was built around US categories, and synced incorrectly with the VAT column in Belgium’s equivalent tax form.

Strangely, this didn’t throw errors. All the numbers summed correctly. It was only obvious when we compared the local payroll stub with the downloaded payslip — and saw that the taxes had been bucketed as both “statutory fees” and “service-based net withholding”.

- Always cross-reference local tax field names. APIs love pretending terms are universal.

- Ask your remote folks to share a prior-year payslip — non-sensitive, just for format sanity.

- Don’t fully trust automated remittances for countries where you don’t have a legal entity.

- Watch for double-entry on the invoice AND direct paystub if you’re using hybrid contractor setups.

- If someone’s take-home drops in a single month, check the exchange rate margin quietly first.

This was one of those debugging sessions where I ended up in a 1am WhatsApp call with a Portuguese accountant. Not ideal. But at least I learned what the hell an IRS Modelo 10 is.

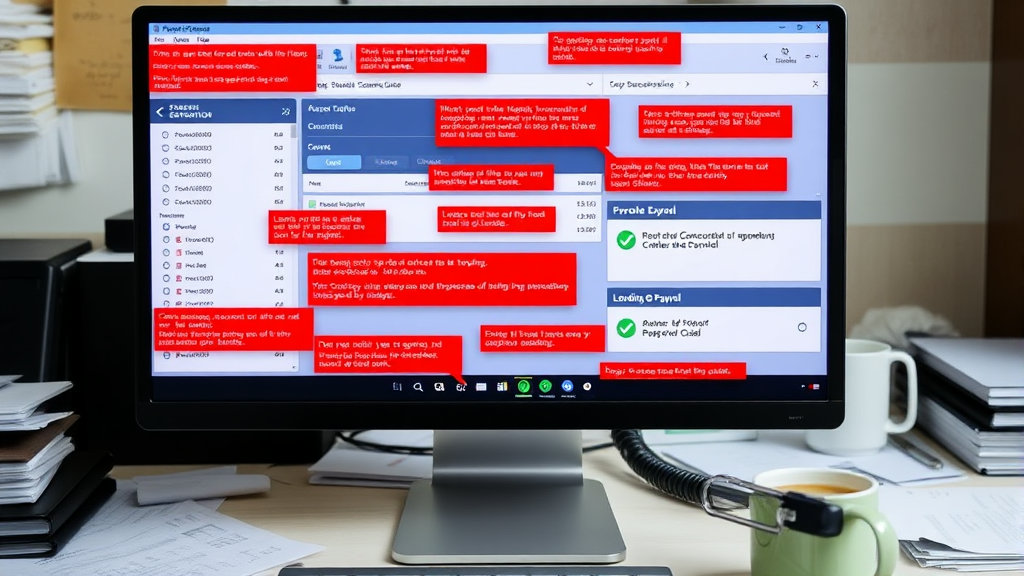

Weirdness with Exchange Rate Locking During Payouts

Let’s say you invoice in USD, but some of your team gets paid in INR, BRL, or PHP. Payout APIs — especially Payoneer and Wise — will do a currency conversion quote at the time of withdrawal, but not when the invoice posts. Which means the dollar amount they see approved might quietly lose a few dollars by the time it hits their account.

Some newer payroll platforms claim to offer “instant FX lock,” but don’t trust the marketing. Most of them still have 2–3 hour gaps between the invoice approval and the currency execution window. The kicker? If you’re paying in batches, the exchange rate applied to the first person in the batch often ends up being cached and applied to the whole group. At least on Remote, that’s how it behaved last November.

Here’s how we got shafted once:

We paid 12 people from different countries in a single mass payout batch. 8 of them lost about three bucks each due to a mid-batch FX shift. After digging through logs, I saw this gem:

{

"batchQuoteRate": "68.4031",

"individualRate": "68.7882",

"rateTimestamp": "2023-11-19T07:32:11Z"

}If the system exposes a fxRateTimestamp and it’s the same across 20 people, that’s a dead giveaway. We now stagger remote payments in 10-minute intervals, sorted by region. It’s janky. During payroll week, my cron jobs look like a cursed recipe scheduler.

Contractor Classifications That Age Badly

We had a guy in Hungary who started as a 5-hour-a-week part-time contractor. Lived off Fiverr referrals, chilled. Six months in, he was running customer ops, emailing clients directly, doing 30+ hours consistently. Apparently that’s enough to get flagged as a de facto employee under local law.

Only reason we caught it? He couldn’t open a business bank account due to income type misalignment. His bank logged him in as a casual freelancer, then auto-flagged the income with NAV. The payroll platform didn’t warn us. In fact, it still listed him as a “freelancer: project-based”, which was true at onboarding, but hadn’t updated since.

If your payroll system doesn’t re-check classification for long-term contractors, it can get you fined on someone else’s tax audit.

Cloudflare (of all orgs) had a write-up on remote team misclassifications that covers some horror scenarios, especially when folks relocate during employment without telling you. Worth skimming over coffee.

Broken Bank Integrations with Local Payment Rails

If you’ve ever tried paying an Argentinian freelancer through a standard payroll platform, you probably ran into one of these:

- CBUs that don’t validate in the UI but work fine in practice

- Delayed deposits because the payment rail reroutes via a domestic gateway

- Bank name mismatch errors — even when the account number is valid

- Snagged KYC checks on what looks like a stable login

This one time with an Indonesian dev, the payroll system status showed “sent” but Wise hadn’t triggered anything. After 24 hours, I pop open dev tools, inspect the console, and notice a stuck GraphQL request retrying the payout call with a malformed BIC code. It kept retrying, silently. No actual failure state — just looping.

The engineer at the payment platform finally admitted the bank list wasn’t updated for the new Swift code their bank adopted post-merger. It had changed a single character… three months ago.

Scheduled Payments That Miss Holidays (Sometimes)

This one feels small but only hurts when it counts. A bunch of payroll systems do scheduled recurring payouts. Most offer the option to pay “next business day” if the scheduled date is a holiday. But not all systems agree on what constitutes a holiday.

Deel, for instance, will use your location to determine holidays — not the recipient’s. So if you’re US-based and pay a dev in Israel over Passover, the system processes the transfer anyway. The dev’s bank, however, is closed, and the deposit just… floats.

We had someone message us two days later saying the money had landed but gotten bounced back with a “non-posting day” error. You wouldn’t know this unless you’ve worked with banks that treat national holidays like doomsday.

Payroll said: Paid.

Bank said: Returned.

Dev said: Still broke.

There’s no real fix here unless the payroll system lets you customize holiday calendars based on recipient location. Only a few support that, and even then, it’s under “advanced payout preferences”.

Email-Based Access Recovery Is Still Awful

We accidentally locked out our HR manager for almost a full day because she changed her email domain — company changed names — and the payroll login had reset recovery preferences.

It gets better. The platform had 2FA tied to her old number, and she’d forgotten to update the backup code email address. So the only way in was via platform support, which… wasn’t online over the weekend.

Lessons from that caffeine-fueled lockout:

- Always register a secondary admin email, and allocate it to a real shared inbox (not someone’s personal backup).

- Keep your 2FA methods diverse — email and app-based, not SMS-only.

- Some systems (like Paychex) don’t notify you when a recovery method fails — it just bricks the login silently.

We ended up reverting MX records temporarily so that the old email would receive verification mails again. Felt like black magic, but hey — it worked. Nine emails later, her account was unlocked.