Fixing Your Business Credit Score Won’t Matter If These Tools Are Lying to You

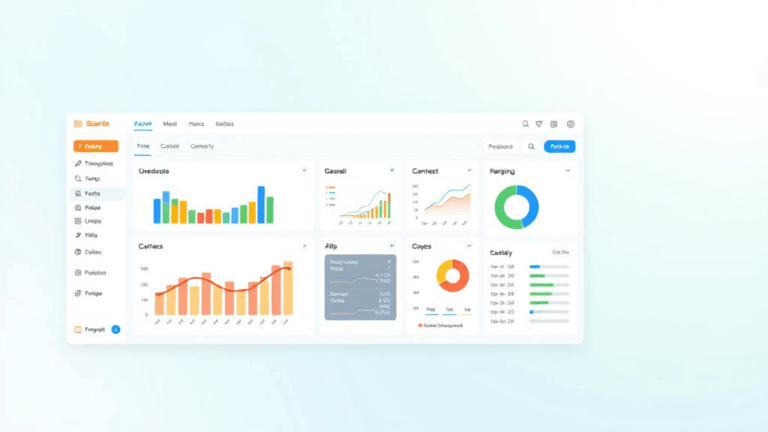

Why Your Paid Credit Monitoring Tool Might Be Gaslighting You

I was paying almost forty bucks a month for one of those all-in-one business credit reports—the kind that promises scores from all bureaus, alerts, insights, maybe even a back rub. And yet, when I had an application for net-30 terms denied, the vendor mentioned something about a low Experian Intelliscore. Funny thing is, my dashboard showed “No negative items” and a “strong score.” Naturally, I called support. Dead air. Rechecked the fine print: “Data updated monthly.” Cool—except it had been updated twelve weeks ago.

Here’s what’s missing in the marketing gloss:

- Most services only pull *some* data (Equifax, yes; Dun & Bradstreet, maybe; Experian, probably stale)

- Data syncs are usually monthly or worse, and almost never real-time

- Some tools don’t include UCC filings or payment trade lines unless you upgrade (even if they advertise that they do)

- The “alerts” are based on batch jobs, not actual bureau pings

So when a lender pulls your file on Monday, they might be seeing a completely different picture than the one you’re getting on Thursday. This isn’t a user error—this is by design.

Differences Between SBA, Dun & Bradstreet, Experian, and Equifax Reporting

This one’s a rabbit hole. Business credit is not consumer credit—and trying to improve yours using personal credit repair methods is like pasting Bootstrap into a React component. Doesn’t end well.

Each bureau has its own data vendors, scoring algorithms, refresh cadence, and insane inconsistencies. For example:

- Dun & Bradstreet: You can’t even get a D-U-N-S number manually verified without supplying records that take 30–60 days to process. And if your business name contains “LLC” or “Corp” inconsistently, it might ping as a new entity.

- Experian Business: Intelliscore uses a mix of public records, payment history, and industry classification—but if a net-30 vendor doesn’t report, it literally changes nothing.

- Equifax Business: Pulls public records (tax liens, legal judgments), but their trade line data is weirdly sparse. Also, it seems to rely more heavily on SIC codes than the others.

The SBA doesn’t have its own bureau per se, but banks offering SBA 7(a) loans will often pull a FICO SBSS score, which blends your personal credit (yeah, you) with business tradelines. Something they don’t tell you until after the denial letter.

I once corrected a typo in my street address with D&B and, for some reason, my PAYDEX score plummeted—turns out they revalidated the entire company, and all the past payment data de-linked from my EIN. They reattached it six weeks later. No apology.

Vendor Tradelines You Think Are Reporting… And Aren’t

There’s this myth among new LLC owners that if you buy a ream of paper from Quill or get a $300 office chair on credit from Grainger, your score will skyrocket. Nah. Half these vendors either don’t report at all or only do so on their quarterly batches—and only to Dun & Bradstreet.

I’ve verified these weren’t reporting as of last pull:

- Uline: says they report, but I had six consecutive on-time payments that never showed up on Experian

- Summa Office Supplies: they’ve become a meme in credit forums. Needs a $60 order *and* manual net-30 approval, but still didn’t report after 90 days

- Granger: optional reporting, tied to business volume thresholds you don’t find out about until asking support

What actually reported? NAV. They file as a financial utility, and their Builder account—at least when I signed up—guaranteed monthly reporting to all three major bureaus. Weird workaround, but it worked.

“We report all NAV Builder accounts within 30 days of payment clearing. This includes Experian, Equifax, and D&B.” — buried three paragraphs down in a support doc.

Half the game right now is figuring out which vendors report without checking your personal credit, and which just say they do for marketing points.

Soft Credit Pulls That Still Affect Lending Decisions

This bugged me for months. I tried to keep things clean—no hard pulls, good personal FICO, decent business file. Then I got turned down for equipment financing despite pre-approval. Reason? “Unfavorable recent inquiry volume.” But I hadn’t applied anywhere else.

Turns out some soft pulls done by credit monitoring services (looking at you, NAV and CreditSignal) actually show up in Experian’s business risk model. They’re labeled differently—but some underwriting systems treat any recent inquiry logged as a sign of liquidity chasing.

So if you’re stacking up tools for monitoring—probably a good idea—but use sandbox mode or read the fine print. I had four soft pulls over 30 days and didn’t realize they were still visible to lenders. It’s not disclosed during signup.

Also, if you’re syncing your business email with Gmail, some third-party finance apps request view-only access to PDF bank statements. Doesn’t trigger a hard pull—but I’ve seen some fintechs use that metadata to pattern match business behavior. Gray area, possibly against TOS, but there it is.

Fixing Bad Trade Data – When to Bother, When to Let It Rot

I fought with D&B for three weeks in 2022 over a single ridiculous late payment claim from an unverified account with no phone number or invoice history. They told me to resolve it directly with the vendor that I had never actually done business with. Meanwhile, my PAYDEX score was stuck in the 40s.

Eventually a rep from their Data Resolution Group helped me if I provided proof of non-engagement (credit card statements, tax records). It looked like this:

Subject: Trade File Dispute

Claim: $237 Late Payment - March 2022

Vendor: UNKNOWN LINE OF CREDIT - MIDWEST REGION

Submitted Evidence: IRS Form 940 Q1-Q2 (no purchases), AmEx statements (no charges)The catch? They couldn’t remove the line, only flag it as “disputed.” The score didn’t recover until it naturally aged out after 12 months. If the impacted bureau isn’t the one your lender checks, it’s often not worth it.

What is worth it? Verifying every merchant that reports your trade data. I now email accounting teams a pre-written template whenever I open a new net account. Not glamorous, but it’s shaved weeks off data disputes.

Using JSON Verification with Certain Fintech Lenders (Yes, really)

This one caught me off-guard. Some B2B lenders now let you verify business revenue by uploading a custom JSON payload from your accounting software. I used Wave Accounting, exported a modified transaction history with custom tags, and injected it into their API sandbox. They approved it.

No docs, no bank login. Just structured data in a predictable format. I only found this because I reversed one of their frontend workflows using Chrome DevTools after a failed OAuth attempt. The network panel logged this JSON:

{

"statementSummary": {

"totalRevenue": 8932,

"averageMonthly": 1786,

"transactionCount": 42,

"verifiedSource": "Wave"

},

"businessMetadata": {

"entityType": "LLC",

"verifiedBy": "admin@mycompany.biz"

}

}Not all lenders accept this, obviously, but for those that do, it’s an edge-case lifeline. Especially if your bank data’s messy or split across multiple institutions.

Interpreting Mixed-Score Environments When Rejected

My own PAYDEX was around 75, Experian at 62, and Equifax had me at 3 (yes, three) for no obvious reason. Still, I got approved for a working capital line… once I sent in a letter explaining my trade lines manually. Turns out certain underwriters use what’s called an internal blended matrix—a scoring model that prioritizes vendor reports over bureau scores.

This part isn’t advertised. You will not see it in brochures. But if you get a generic rejection, call and ask specifically: “Was this based on a bureau score or blended matrix rating?” Some reps will tell you. Some will just grunt. But it’s worth it.

The logic flaw is this: automated decisions are made off inconsistent data, but humans in underwriting can override if you supply paper trails. People skip this step because they assume the computer has final say. It doesn’t.

And if you ever get referred for review instead of an auto-response, that’s your chance. Pull credit manually and send in supplementary docs—even screenshots from your monitoring tool. It shouldn’t help, but sometimes it does.