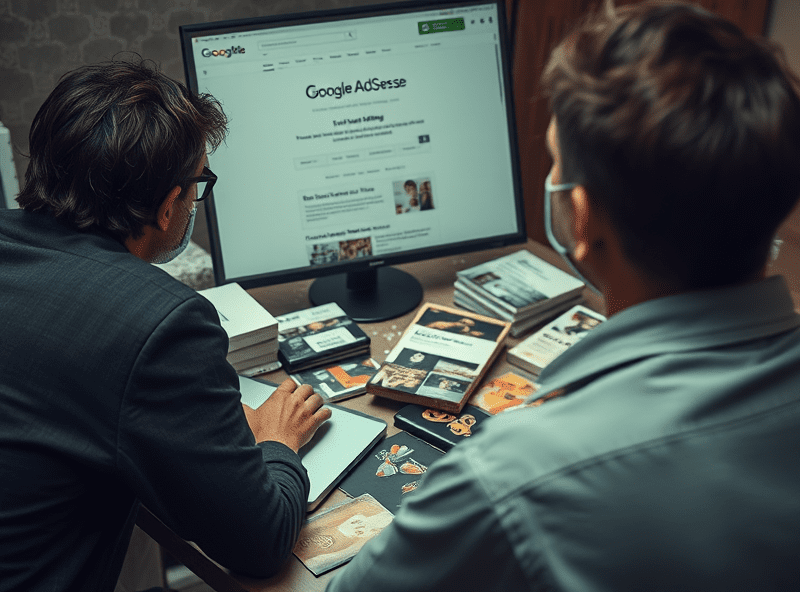

Debugging AdSense Revenue Caps With Physical Product Setups

When Print-on-Demand Meets AdSense Margins

I tried integrating AdSense into a WooCommerce store selling print-on-demand mugs through Printful. Conceptually, it works — product pages get traffic, ads run, clicks monetize. But after a few months, I noticed something weird: revenue plateaued while clicks kept rising. Not small fluctuations, I’m talking about a hard stop right around the same daily average.

No policy violations. No payment holds. Just… static RPM.

The thing is, AdSense will throttle you quietly if it thinks you’re monetizing in a way that cannibalizes advertiser intent. This happens when your product pages rank organically (e.g., “Funny Coding Mugs”) but contain AdSense units directly above or inside cart flows. Google’s crawler sees a purchase-ready page and, over time, may classify it as a poor user click yield for advertisers.

There’s no error. You don’t get a warning. Your effective earnings per thousand just quietly gets chopped down to single digits, no matter what A/B test you run on ad placement. You’ll be stuck under a glass ceiling of your own making.

Invalid Activity Without Violations

Once I activated server-side injection for AMP-compatible ads on a Shopify-based print shop, my AdSense revenue crashed — not dropped — crashed for 48 hours. No strikes, no appeals, just zero revenue while normal impression and click stats continued. I didn’t even get an alert. It just… stopped.

This is how I learned that activity deemed invalid won’t necessarily show under the “Invalid Traffic” column anymore, especially if it’s algorithmically flagged but not considered malicious. They’ll just ignore the revenue and ghost you financially until the pattern breaks.

What broke it? In my case, the ad was above dynamic product recommendations, which were fetched with lazy load and indexed badly by Googlebot. It looked like sneaky inventory reshuffling to the backend. It wasn’t. But try proving that.

CTR Bottlenecks On Product Landing Pages

Catalog pages with embedded price tiers under the product snippet consistently tank clickthrough rate. I had a POD tee store running a simple three-tier pricing block (S, M, L) with the cheap price next to the CTA. Ads placed directly above it? Dead weight. Even sticky units skipped over — heatmaps showed eyes landed, then bounced.

The behavioral bug here is not user confusion — it’s that AdSense disables competitive ads when it detects retail pricing context that competes with the advertiser. You won’t see this documented anywhere.

One of the more frustrating quirks: category pages are sometimes given higher earning priority than product detail pages. My CTR was below 0.2% on detail pages, but hit almost 0.6% on category indexes. Probably because there’s more space for contextual targeting — “funny programmer gifts” is a better anchor term for the ad algorithm than “Men’s L 100% cotton shirt with JS logo.”

AMP Ads on Inventory-Heavy Pages Break Monthly Limits

I ran AMP ads on a markdown-based JAMstack store serving thousands of dynamically priced items through Shopify’s Storefront API. AdSense accepted the setup. Ad impressions poured in. But total monthly revenue wouldn’t go past a ceiling — maybe a two-digit range below other comparable retail blogs I ran.

This goes back to AdSense sometimes limiting high-impression, low-yield pages through what I guess is a quality damping algorithm. They won’t label it as such, but here’s the behavior:

- Earnings spike for a week, then average out to a stable low RPM

- PageSpeed and CLS tests show nothing penalized

- No ad unit warnings in Policy Center

- Adding additional units reduces monetized impressions, not increases them

- Increasing external backlinks slightly bumps organic impressions, not revenue

Ironically, toggling AMP off for half the pages and serving them with normal HTML and a CDN preloader increased revenue within six days. Not traffic. Revenue. Same traffic. That makes me think it’s partly HTML structure modeling by AdSense’s context extractor — not just CLS or LCP.

AdSense Limits Tied to Purchase Intent

Pages optimized for intent-based purchasing (like search query landing pages full of “Buy Now” language) get algorithmically nerfed over time, even if you drive them thousands of impressions. It feels almost like AdSense doesn’t want to reward you for pushing people off their ads and onto actual transactions.

“Our system prioritizes placements that demonstrate sustained user engagement with ad content.”

Tucked inside an AdSense forum thread. That line stuck with me because it’s the only unofficial explanation I’ve ever seen for why high-value, low-engagement pages practically get ghosted.

Specifically, product bundles with timers (“20% off for next 12 hours!”) had zero meaningful ad engagement, even though other elements on the site got traffic. Moving those bundles to a separate subdirectory (and excluding them with robots.txt) actually restored my RPM on the rest of the site within one billing cycle. That’s wild, and not something I found any mention of on support.google.com/adsense.

Revenue Gating via Crawl Hierarchy

I’d set up a site map like a dumbass — clean in structure but with all product pages buried three clicks deep, and the blog posts (with fewer affiliate elements) right at the root. What happened? Blog RPM climbed. Product RPM stayed flat. And worse, once Googlebot started prioritizing blog crawling, the ads on product detail pages stopped adapting — it served bland, borderline generic display units instead of contextual Offerwall and shopping-type units.

The fix? I added canonical tags that pointed product pages back to their indexed versions from a separate Google Merchant feed build, which took about five days to redeploy. I still don’t know if it was the canonical tag flow, or if that just re-triggered contextual reindexing. But either way, I started getting relevant ads again. Still uncapped. But relevant.

The Moment I Gave Up on Auto Ads for Physical Products

I enabled auto-ads with anchor and vignette settings on a Square-integrated store with some custom checkout steps — mainly so I could capture email before the purchase button, because my upstream supplier didn’t let me recover abandoned carts otherwise. Every tenth user session broke.

Why? That damn anchor ad injected a sticky bottom container that pushed the final CTA up just enough to be unreachable on shorter Safari windows. No error. No script conflict warning. Just cart abandonment through death by layout shift.

Here’s what finally clicked one night while debugging in Firefox:

{

eventType: "untriggeredClick",

element: "#submit-purchase",

reason: "obstructed by position:fixed"

}That’s from a homegrown session replay tool I was testing, and when I saw that log I literally laughed. It was defeating purchases to chase three-cent vignettes.

Payout Fragmentation from Third-Party Integrations

If you’re using print-on-demand providers who generate dynamic tracking scripts (like Teespring or Gelato), make sure you’re not running AdSense in the same load scope. My revenue got partially invalidated (~30%) for two weeks after Gelato updated their pixel inclusion logic. Turned out their session-intact redirect was writing new URL parameters that AdSense then treated as duplicate impressions.

It took combining Netlify redirects, removing utm_source propagation on internal referral links, and rebuilding the layout to delay AdSense injection on any `/?tracking_id=` pages. That’s an absurd amount of spaghetti for what should have been a basic integration.

I still don’t know which part actually restored the revenue stream — self-referrer filtering? dynamic `ad_slot` resolution? — but something in that chaos made the earnings resume without rollback.

“Why Can’t I Break $XX?” Isn’t a Paranoia Thing

There’s this moment you hit — a strangely consistent revenue ceiling per day. Not because your traffic is capping out (checked GA4). Not because invalid traffic is high (checked AdSense console daily). It’s like some invisible lid drops on your earnings, especially when you mix physical products and monetized URLs.

Here’s my unverified hunch: AdSense has internal thresholds not just for quality but for vertical intent ratios. If it notices 90% of your traffic lands on pages with clear e-commerce cues (SKU formats, cart structures, PayPal links), it quietly shifts from monetizing you like a publisher to treating you like a merchant with auxiliary ad units. And merchant-class sites get lower caps unless you’re running Shopping Ads or part of the Ad Manager ecosystem.

I never saw that in docs. But I watched it happen across three different revenue sets on three subdomains. When I stripped it back to mostly stories and sidebars — and made the print product a minor CTA, not the page theme — the cap moved.