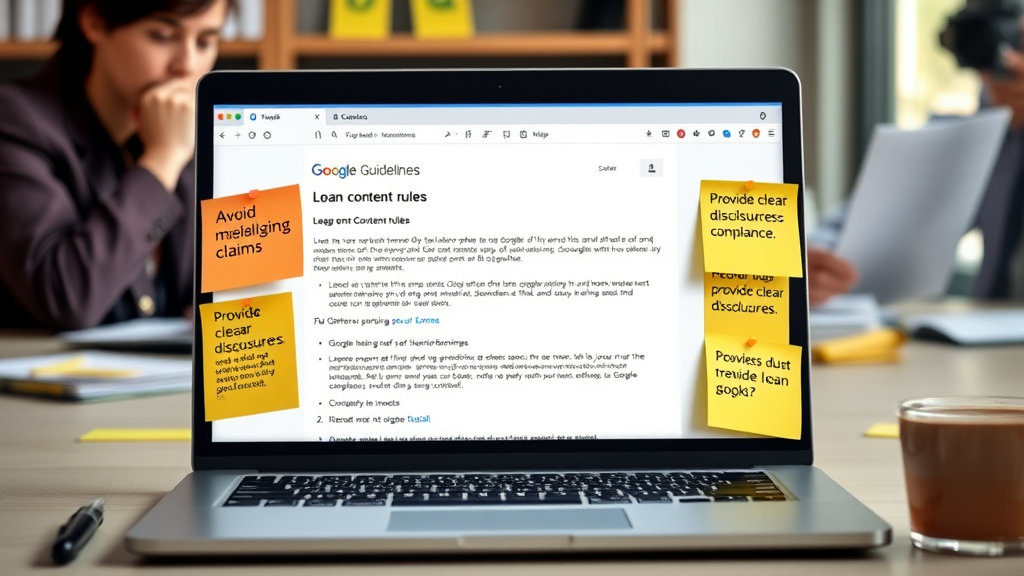

Avoiding Takedowns Under Google AdSense Loan Content Rules

Don’t Assume Disclosures Fix Everything

If you’re pushing financial content, especially around payday loans, crypto-backed lending, or high-risk investor programs, you’ve probably tried walking that line—include some disclaimers, slap on “for informational purposes only,” and call it a day. That used to work. Doesn’t anymore.

The AdSense Financial Services policy doesn’t just care about whether you say something is not financial advice. It cares about whether the content might lead users to a financial product or decision. I had an old post ranking well—a piece on high-yield lending platforms for digital nomads—and even though I clearly labeled everything as non-advisory, AdSense flagged it under their “loan matchmaking” language. No direct conversion link. Still got dinged.

Turns out, even URLs commonly associated with applying for loans (think affiliate redirects or obfuscated tracking links) can trigger issues, even if the target page doesn’t offer financing directly. They’re looking at intent, not just CTA copy.

Policy Enforcement is Pattern-Based and Weirdly Retroactive

One weekend I woke up to five policy violations on posts that had been untouched for a year and a half. All flagged under “Unapproved Financial Services Advertising”—no real details. After manually cross-checking the archived versions, nothing had changed. I reached out to AdSense support, and—no surprise—got the default link to support.google.com/adsense policy pages.

What worked (eventually) was rewording everything: instead of saying “Compare loan terms across multiple platforms,” I switched to “How users explain their loan experiences with XYZ companies.” The framing made it perceived as reporting, not promotion. I also stripped all outbound links, even neutral ones like credit score calculators—one of those had been flagged for being “misleading.”

Bug: You can still get flagged even if the AdSense crawler doesn’t index the page content but follows a link that leads to lending content. Turns out they sometimes rely on automated context propagation from link targets.

Crypto Lending Is Practically Radioactive

Don’t bother trying to write about Celsius, BlockFi, or any of the lending products baked into DeFi platforms unless you’re okay with going ad-free. Even if you’re reporting on their collapse or regulatory scrutiny, AdSense makes no nuance distinctions. I learned that the hard way after a write-up about collateralized lending on Aave led to a sitewide violation notice.

Ironically, the post wasn’t even promotional. It was a takedown of their opaque risk modeling. But I’d included a few screenshots and a link to their docs. Apparently that was enough. After stripping everything including basic terminology (Words like “yield farming” or “collateral” are potential red flags), the flag went away after about ten days. But the RPM hit lingered.

Aha lesson: If the platform you’re describing enables borrowing, it doesn’t matter whether you link inbound or outbound. Their automated policy model identifies platform names + financial verbs together as risk context.

Loan Aggregators Are Hard-Flaggable, Even If You’re Comparing Only

This one still annoys me. There’s a whole category of content where people write about aggregator tools—NerdWallet, Credible, SuperMoney, etc.—not promoting them, but reviewing their UX or process. Turns out AdSense might see you as a disguised intermediary.

I got flagged on an article breaking down the UX differences between LendingTree and Bankrate. Zero monetization paths linked. No CTAs. But I embedded their homepage screenshots. That was apparently too close.

What I changed to clear the violation:

- Removed logos entirely

- Changed all mentions from “loan platforms” to “financial comparison websites”

- Minimized direct brand names, used generic descriptors

- Emphasized that users should contact a financial advisor before making a choice

- Moved sidebar AdSense placements off the article template

Once that was done, no more issues. But the analytics showed a residual tanking in CPC across the site for about a week. So even cleared violations can shadowban you in all but name.

Edge Case: Embedding Rate Tables from a Bank

This one’s obscure, but worth noting. If you embed a JavaScript-based rate widget from a banking institution—for example, a live mortgage rate tracker—it can trigger a policy violation if the widget’s source mentions terms like “loan”, “APR”, or “apply” in the DOM.

I had grabbed one from Capital One (or maybe Wells Fargo, hard to remember because I was testing three), and stuck it in a “Loan Trends” sidebar on a fairly chill analysis page. Two days later: full demonetization of that post. There was no affiliate structure, just a raw code embed.

Turns out AdSense parses third-party DOM text in simple iframe embeds if they’re from major banking domains. Even though the user didn’t interact with it. Wild. Replacing with a plain SVG chart I made in Figma stopped the false positive.

// Here’s a non-working snippet that caused the trap

<iframe src="https://xyzbank.com/widgets/rates"></iframe>

// The inner content had <div>Apply for a low-interest personal loan now</div>

Avoid Mixing Loan Topics with Debt Settlement or Credit Repair

Quick tip that saved me from a third strike: don’t cluster your content categories around finance-adjacent topics, especially if you’re also covering legal help, debt assistance, or “how to raise credit scores fast”. Even if your individual pages are clean, AdSense often pulls context from nearby sections and sidebars.

I had a content folder labeled /finance-hacks/, and it had articles on budgeting, debit ratios, and a one-off piece on debt negotiation scripts. Guess which one fired up the enforcement AI? Even though it wasn’t monetized directly, the presence of email submission offers and templates made it look like lead gen. Coupled with a solid article on comparing small business lines of credit, the system paired them in a quasi-topic cluster and flagged both. Same week, my match content ads dropped off a cliff.

What worked was re-theming the folder paths (manual redirect hell), scrubbing any promotional-sounding CTA copy, and splitting financial from legal/consulting tips. Tedious, but the ads came back.

AdSense Policy Prevents Monetization by Country, Not IP

This tripped me up in early testing. I built a subdomain targeting Latin American fintech comparison markets, including a few dozen posts on quick loan apps in Chile, Mexico, and Brazil. All of them followed country-specific advertising rules and platform disclosures. But AdSense blocked monetization of most of them. Why?

Turns out their country-based restrictions operate off content language + page targeting metadata, not live visitor IPs. So you can get hit simply for describing lending practices tied to countries where AdSense doesn’t allow that category—regardless of where your page is shown.

Some of the affected pages weren’t even getting traffic from users in those regions, but because phrases like “préstamo en línea rápido” and “tasa fija en CLP” appeared, their scan engine triggered on regional loan context.

Got around it by either:

- Removing specific regional currency or product references

- Adding a styled banner saying: “This article does not offer financial products or advice in X country”

- Taking the hit and going direct affiliate instead of AdSense

That content couldn’t run ads under the default rules, so it either had to convert in other ways or sit inert.

When Google Flags You But Doesn’t Show Violations

You ever check your AdSense policy center, see zero violations listed, but notice that one or two posts have no ads when others do? No warning, no yellow bar—just quiet exile. That’s soft deactivation. It doesn’t show up unless you hit certain flag density or account thresholds, and it might never be acknowledged.

Confirmed that with a guy I know who used to work with publisher quality algo review (hell of a job). Apparently, certain keywords trip a secondary review state: ads will not show, RPM drops, but no visible reason is given. Example phrases I saw this happen with:

- “debt stacking strategy”

- “unsecured lines of credit for new grads”

- “fast cash loans with no employment verification”

Removing those phrases—not even the topic, just the phrasing—brought ads back. Keep that in mind when diagnosing ghost drop-offs.