Changing Tax Info in AdSense Without Nuking Everything

Where to Actually Change Your AdSense Tax Details (No, It’s Not in the Obvious Place)

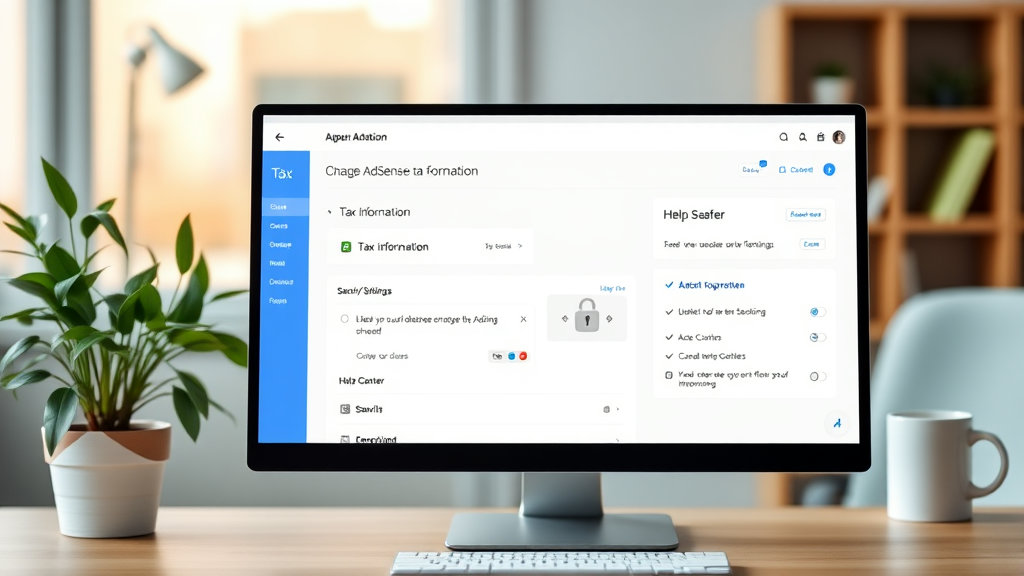

If you’ve ever tried updating your tax information in AdSense, you probably ended up clicking around in circles in the Payments section until sundown, wondering why the option to “Edit Tax Info” just… doesn’t exist. That’s because it’s buried in an obscure corner of the UI: Manage settings → United States tax info → Manage Tax Info. That’s the only place it lives. You won’t find it under the “Tax information” section in the profile (why that exists is another mystery).

I spent 40 minutes once trying to find it during a Skype call with a client. Turns out, if you’re logged in under an account that isn’t the primary payment profile owner, you’ll literally see nothing. No button, no warning, nothing. It silently suppresses the section like it’s a security vault made of CSS.

The behavior that really messed with me? If you’ve submitted tax info once and then your account type changes — say, from individual to LLC — the system doesn’t flag that anything’s wrong. Your old W-8 form stays on file and AdSense happily continues payouts… until the IRS mismatch triggers a hold, which they email at 3am and call a “tax validation discrepancy.”

Form Selection Woes: W-8BEN vs W-8ECI and Friends

AdSense tries to auto-suggest which form you should pick, but it’s based on how you answered one very ambiguous question: “Are you an entity operating in the US?” Except if you check “Yes,” it assumes you’re submitting a W-9, even if you’re a non-resident LLC. But if you check “No,” then a W-8BEN or W-8BEN-E might get loaded by default, which isn’t useful if your income is effectively connected to a trade or business in the US (cue W-8ECI).

Here’s the deal: if the income is from ads shown to US traffic, that alone doesn’t mean you’re effectively connected. But if you have a US mailing address, or bank, or any kind of agent — the IRS might treat your revenue as taxable under ECI rules. Most creators outside the US just pick the W-8BEN and pray, but there are scenarios where that’s a real misreporting risk.

“If you’re earning $500+/month consistently and routing payouts through a US platform… W-8ECI might actually apply, even if you never step foot in the country.”

Yeah. Found that out the hard way when I got a lovely letter from the IRS asking for backup documentation, two years into self-employed life.

What Happens After You Submit: The Mysterious Processing Black Hole

So, after you pick your form, fill it out, and click Submit, there’s a moment of silence. No loading spinner. No confirmation. Most of the time, it just snaps back to the main tax info dashboard, and you see “Status: Approved.” That’s it.

Until it’s not.

I once submitted a W-8BEN-E for a client and saw the status flip to “Under Review.” What does this mean? Absolutely nothing clear. There was no documentation deadline. No contact. Then three days later, everything vanished — poof — and it said “Form Rejected: Signature field invalid.”

Turns out if you use a special character in your signature (like an accent mark), the validation parser breaks and doesn’t throw an error. It just silently fails and marks the form for rejection. The logs — if you can even get access by emailing support 6 times — just say “PDF signature parse error.”

Best advice: avoid anything in signatures that isn’t basic ASCII. No foreign characters, emojis, or even dashes that look prettier than others. Keep it boring. Stick with default fonts. This thing was coded like it’s allergic to UTF-8.

Changing Legal Identity: Individual to Business = Nuclear Scenario

Here’s the edge case that nuked an AdSense account I help oversee: we switched from an Individual to an LLC midstream. That includes new tax forms, new TIN (Taxpayer Identification Number), and updated billing info. All of that is fine except… Google doesn’t let you change the payee name.

The payee field is frozen once the account is fully set up. That includes the tax status too. Yes, there’s a form hiding in support somewhere that allegedly lets you request a business entity switch… but even if you find it, most of those requests are “denied due to risk assessment” without any appeal. We ended up having to open an entirely new AdSense account.

They say AdSense can’t merge accounts anymore due to “compliance reasons.” Sure. But they don’t warn you when choosing an account type that it’s basically permanent unless you abandon the account. You can literally change every bank detail, every PII field, do phone verification again — but not the name of the entity being taxed. Cool.

The soft workaround? If you already own a business, just create the AdSense account as the business from the start. If you’re going to scale beyond hobby level, switching later is a trap door. Don’t fall through it.

Multiple YouTube Channels? Each One’s Revenue Has Different Tax Logic

This tripped me up like five separate times on client accounts. If you’re running multiple YouTube channels under one AdSense account, the tax treaty and withholding gets applied at the account level — not per channel.

But here’s what’s subtly broken: if you change your tax form (say, moving from W-8BEN to W-8BEN-E because your business structure updated), your old revenue reports still reflect the previous tax rate.

So in payout CSVs, you’ll see earnings from Channel A taxed at 0%, Channel B at 30%, and it’ll make zero sense unless you track when the form was updated. Their reporting UI doesn’t flag the cutoff point. You basically need to start timestamping your tax form updates manually if you want to match up discrepancies later.

Also, per-channel revenue sources — for example, embedded YouTube videos with AdSense vs standard in-stream ads — may trigger different IRS classifications. Especially if one uses custom monetization workarounds or MCNs.

The Strange Case of Invalid Tax IDs That Still Get Approved

This one’s frustrating. There are several validation layers for the TIN field (Taxpayer Identification Number), but they’re mostly cosmetic. The system checks if the format matches — like nine digits for US SSNs or EINs — but doesn’t actually verify against real registries in real time.

So if you enter 123456789 as your EIN, but it’s not assigned to your business by the IRS? No red flag. You’ll still get “Status: Approved.” What happens is the IRS catches it retroactively — usually weeks or months later — and then contacts Google, flags the account, and your payout status quietly becomes “On Hold.” No notice. No warning.

To make it even more fun, when you later fix your TIN and re-submit, there’s no retroactive adjustment. So the prior earnings remain misclassified. This matters if treaty benefits were applied and now need to be revoked. Technically, Google could issue corrected 1042-S forms — but good luck getting that done without enterprise-level support access.

Tips That Saved My Sanity (and Probably My Audit Risk)

- Always submit tax forms in Chrome with extensions disabled. The form iframe behaves differently if blockers are active.

- Use the plain signature option instead of drawing if your input device is shaky — I once triggered a fraudulent file flag using a Wacom tablet signature.

- Don’t update banking and tax info in the same 24-hour window — it’s more likely to trigger a risk flag that pauses payments.

- Keep a PDF copy of every submitted form. Google won’t send you one unless you print it manually from the confirmation screen.

- AdSense doesn’t validate international tax IDs (like UK UTRs), so use the appropriate treaty article and leave ID blank if unsure.

- Use an email address that’s not tied to your Google Ads login when contacting support — they sort tickets differently based on associated services.

- If you use a cash app-type payout method (e.g. Wise), make sure it can receive transfers under your payee name or risk a bounce-back with no error message.

What “.jsonTaxOnHold”: true Told Me About Pending Holds

One weird “aha” moment I had was when inspecting the response for the Payments tab with devtools open. Buried in the XHR response from `/payments-dashboard-data`, I saw a line like:

"jsonTaxOnHold": true,

"paymentHoldReason": "TAX_DOCS_PENDING_REVIEW"

This showed up about four hours before the UI updated to show that there was a tax info hold. There was no email, no alert. Just quietly in the JSON response, already marked. I’m guessing they process things internally before surface-level statuses refresh, which gives you a tiny window to preempt a payout delay if you’re watching network traffic.

Roughly 6% of the tax holds I’ve diagnosed across client accounts were visible in devtools first. Not saying it’ll always be this way, but next time something looks off, try popping open Network and sniffing around for dashboard-data calls. It’s noisy, but those key-value pairs don’t lie.