How Platforms Misreport Business Insurance Data to Aggregators

Why most comparison platforms show fake diversity in quote responses

This one drove me nuts. I ran parallel quote submissions through four of the top business insurance aggregators—same zip code, same NAICS code, same policy limit, even used the same email address modified with Gmail dots. What came back? Identical quotes dressed up as if they were from different providers. Turns out, several platforms mask underwriters behind different brokerage fronts, which gives the illusion of shopping the market when really you’re just pinging the same two carriers over and over.

Worse, they’ll badge one as “Recommended” and another as “Best Value,” and the pricing is off by exactly zero dollars. It’s the same damn quote.

APIs between brokers and carriers are NOT fully bidirectional

Here’s what I didn’t realize until way too late: the flow of data between most digital-first platforms and actual underwriters is embarrassingly one-way. You send quote data downstream — company name, revenue, years in biz — and you wait. But the platforms don’t always provide hooks to receive error messages or quote-fatigue reasons from the carrier’s systems in anything structured.

So when 70% of the quote attempts come back with “we weren’t able to match you with this provider,” it’s not because your operation is risky. Sometimes the platform just failed to transform your SIC code to the expected risk category, and the carrier’s system silently bailed. No feedback. No retry. Just a fake polite rejection.

Some platforms cache and repackage old quote attempts

This is the part that feels the dirtiest—some quote gathering platforms keep your inputs around, then creatively mash or supplement them with third-party enrichment data (yes, like scraping your site’s WHOIS or LinkedIn company profiles) weeks after your initial request. They try again when they think underwriting models may have changed. If a new quote appears later, it can seem like a “fresh” match — but it’s just a delayed response from data you forgot entering.

One time I got a quote from Hiscox through a platform I hadn’t touched in 3 weeks — turns out they pinged again using my original business description, but swapped in a more “conservative” category and reshuffled addresses via a public dataset.

I found the timestamp in their internal API call log via browser DevTools… I probably wasn’t supposed to see that one.

Why NAICS and business description mismatches silently tank your eligibility

If there’s one consistency across platforms, it’s their total unreliability at mapping your actual business type to something underwriters understand. You type in “podcast ad sales” and they log it as “Digital Advertising.” Then the underwriter sees a potentially high-risk media company instead of the reality, which might be a guy in a t-shirt placing Spotify tokens through a dashboard.

That automatic categorization logic is opaque, often overgeneralized, and almost always locked down from your end. You don’t get to correct it unless the platform supports a manual quote override (most don’t).

A few useful edge-hack tips:

- Use different phrasing for business description if quotes fail — “contract-based email marketing” and “retention marketing services” can yield vastly different results.

- Try SIC code entries manually — browse government NACIS lookup tables to find alternative matches.

- Use Incognito to simulate a “fresh” user if session-based enrichment assumptions are messing with results.

- If you know which carrier underwrites through which platform (some publish it quietly), target the platform with the most appropriate blend for risk.

- Keep old quote confirmations — date-stamped PDFs sometimes trigger “prior coverage” discounts even if you never accepted.

I once used an expired quote from NEXT Insurance to contest a higher premium from the same underwriter via a different platform—and it worked. The broker hadn’t realized the “old” quote was still technically valid under their override rules.

Many “instant quote” buttons are connected to ZIP + revenue matching, not detailed risk models

This one always feels a little like pulling back the curtain on a wizard: those shiny embedded quote widgets on blog posts or fintech dashboards? They’re not typically calling real underwriting engines in real time. Most are feeding ZIP code, industry vertical, revenue, and maybe employee count into a pricing tier look-up table or cached model. You see pricing ranges that look exact, but they haven’t calculated actual risk.

A friend working at a mid-sized broker told me they ran AB tests on their pricing widget and found that showing a “from $42/month” quote based on 5-year-old risk band data converted better than surfacing the true real-time range — even though 40% of users got quoted higher 20 minutes later.

It made sense from a conversion standpoint. But it’s borderline deceptive. And once a user clicks, all context about that guesstimate disappears in the onboarding flow.

Multiple quote platforms resell your data to upstream wholesalers

This one’s gross but predictable. If you go through a slightly sketchy business insurance form (I’m looking at you, the brand that rhymes with ZettleNure), your info may end up in two to three broker CRMs. The resellers pipe forms to both admitted carriers and managing general agencies (MGAs), then forward the most responsive results back to the comparison UI, masking how many hands your data pass through.

There’s no requirement to show which agency name actually handles your policy after purchase. That’s why you may enter your info on a glossy startup’s site and end up getting invoices or onboarding emails from an agency you’ve never heard of in Tampa.

Even better, one flow I tested sent back results from Travelers, Chubb, and CNA—then two days later, I got a cold-call from a broker saying they “noticed interest in general liability coverage.” Yeah bud, because one of your data partners never removed my contact from their funnel logic.

Ghosting a quote process mid-flow can corrupt your profile

So this was weird. If you abandon a quote halfway through — especially on platforms that create session-bound profiles or tie you to a hashed email handle — your inputs stick and may backfill across future quote attempts. Even when using different browsers or IPs.

I hit an endless loop where my worker’s comp quote would fail because they assumed my business had physical locations in two states — because I once tested a multiline input field with multiple cities, and the data stuck to my UID in a way I couldn’t undo without calling the agency.

There’s no real user dashboard to nuke your saved inputs. Best you can do: restart the flow using a fresh burner email + clean session + brand-new user-agent string.

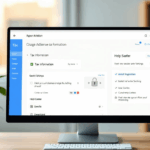

Some brokers gate pricing behind phone calls even though the premiums are fixed

This is a straight-up dark pattern. The broker knows exactly what the monthly premium is going to be — they’ve pulled binding quotes or already run the underwriting in stealth using the initial data you fed the form. But when you reach the final screen, it says something like “An expert will call you shortly with your custom pricing.”

But here’s the kicker: I got a callback within 90 seconds. The rep literally said, “You’ll be at around $68 a month plus fees.” I asked why that wasn’t shown online. He chuckled and said, “We convert better when we talk to people.”

So they manufacture friction just to bump their talk time. And they pull instant quotes pretending to be fielding real-time underwriter feedback. They aren’t.

Watch what embedded traffic monitors YOU during a quote flow

This isn’t exactly underwriting-related but it’s spooky. A side rabbit hole: while debugging response times and field validation during a quote attempt, I noticed a callout to a behavioral analytics service (not Google Analytics — think Hotjar or FullStory) shipping every keystroke and mouse hover. That includes the business keywords you type, even if you later delete them.

Those inputs stay in the session replay, potentially informing re-targeting or even manual underwriting if the brokers watch. One slip-up — typing “cannabis product marketing” then changing to “retail packaging consulting” — could alter who calls you or approves your quote.

I tested it by intentionally backspacing through a list of provocative business descriptions (crypto algo bots! OSHA noncompliant fireworks testing!) before landing on “email commerce.” I still got filtered calls about liability on robotics testing a day later.

The behavior trail matters more than we’d like to think. Even if you never hit enter.